Ace Management Group New Client Data free printable template

Show details

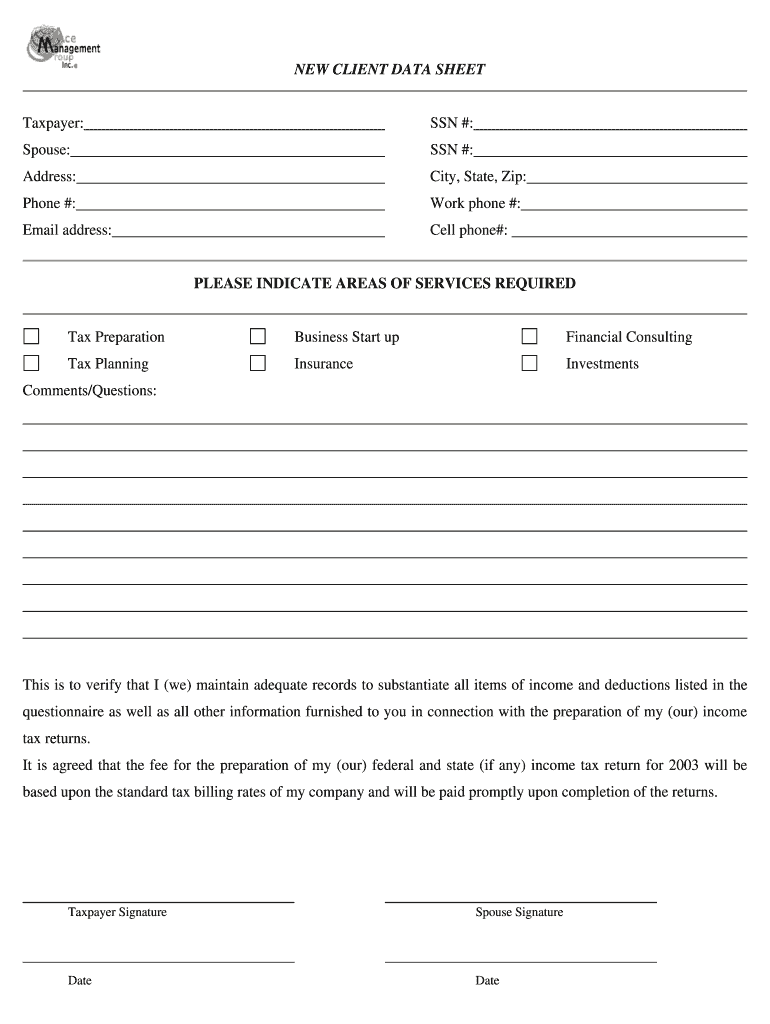

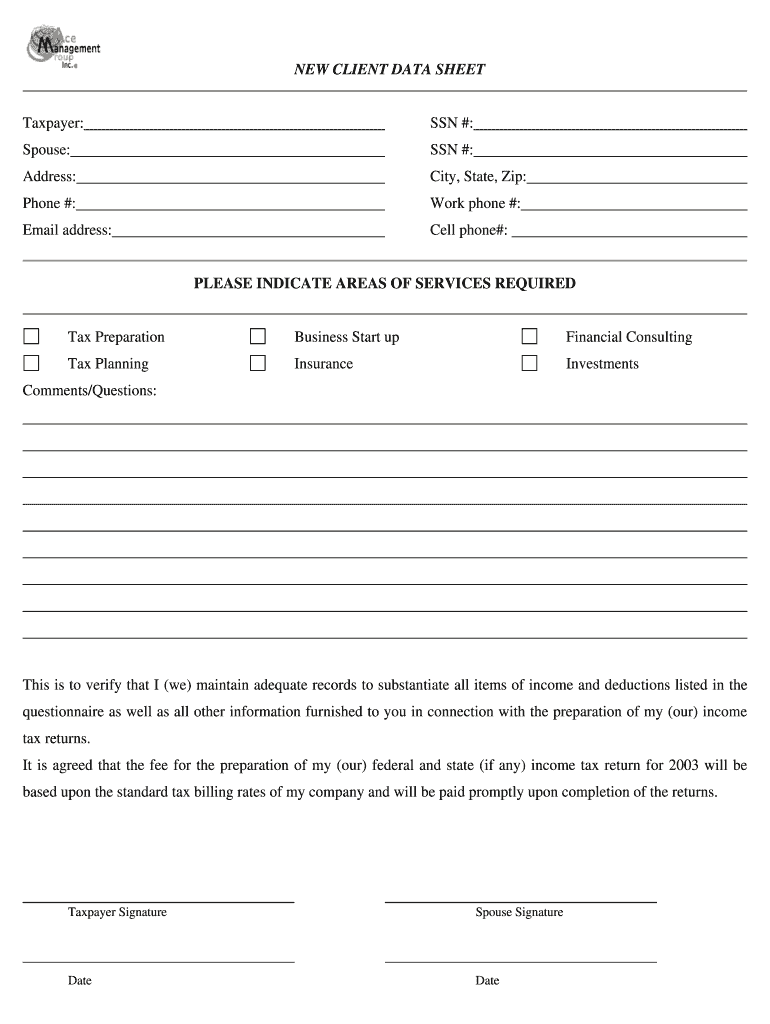

NEW CLIENT DATA SHEET Taxpayer: SSN #: Spouse: SSN #: Address: City, State, Zip: Phone #: Work phone #: Email address: Cell phone#: PLEASE INDICATE AREAS OF SERVICES REQUIRED Tax Preparation Business

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxes sheet form

Edit your tax sheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax preparer templates form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs format for client online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax paper for work form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax preparation documents form

How to fill out Ace Management Group New Client Data Sheet

01

Gather all necessary personal information, including your name, address, phone number, and email.

02

Provide details about your business, including its name, type, and address.

03

Fill out financial information, such as your average monthly revenue, and any relevant banking details.

04

Complete any sections related to your business goals and objectives.

05

Review all entries for accuracy and completeness.

06

Submit the completed form to Ace Management Group via email or online portal as instructed.

Who needs Ace Management Group New Client Data Sheet?

01

New clients seeking management services from Ace Management Group.

02

Businesses looking to establish a working relationship with Ace Management Group.

03

Existing clients who need to update their information or financial details.

Fill

tax information sheet

: Try Risk Free

People Also Ask about tax planning template

What is a w9 form used for?

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions. Mortgage interest you paid.

Who is required to fill out a w9?

You will need to fill out a W-9 form if you: Classify yourself as an independent contractor or “freelancer.” Are not a full-time employee of the business. Will be paid more than $600 for work provided to the business.

What is the difference between a 1099 and W-2?

Wages and other payments to employees are reported on Form W-2, while payments to independent contractors are reported on a Form 1099. Each business must classify its workers as either employees or independent contractors to file the appropriate form.

What is a 1099 tax form?

The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn't your employer. The payer fills out the form with the appropriate details and sends copies to you and the IRS, reporting payments made during the tax year.

What is a 1040 tax form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What is a 1099 tax form used for?

The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn't your employer. The payer fills out the form with the appropriate details and sends copies to you and the IRS, reporting payments made during the tax year.

Is a 1040 the same as a w2?

"No, 1040 is not the same as a W-2. W-2 is a form provided by the employer to the employee that states the gross wages in a given year and all the tax withheld and deductions," says Armine Alajian, CPA and founder of the Alajian Group, a company providing accounting services and business management for startups.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tax preparation forms?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific tax information form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out income tax sheet using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign template for tax preparation and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit tax preparer questions for clients pdf on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as tax client information sheet template. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is Ace Management Group New Client Data Sheet?

The Ace Management Group New Client Data Sheet is a form used to collect essential information about new clients to facilitate their onboarding process.

Who is required to file Ace Management Group New Client Data Sheet?

New clients of Ace Management Group are required to file the New Client Data Sheet as part of their registration and onboarding process.

How to fill out Ace Management Group New Client Data Sheet?

To fill out the Ace Management Group New Client Data Sheet, clients should provide accurate and complete information in all required fields, including personal details, contact information, and any other relevant data.

What is the purpose of Ace Management Group New Client Data Sheet?

The purpose of the Ace Management Group New Client Data Sheet is to gather necessary client information to ensure proper record-keeping, compliance, and to tailor services to the client's needs.

What information must be reported on Ace Management Group New Client Data Sheet?

The information that must be reported includes the client's name, contact information, business details, financial information, and any other pertinent details as specified in the form.

Fill out your Ace Management Group New Client Data online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Form Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.