Get the free printable online tax forms

Show details

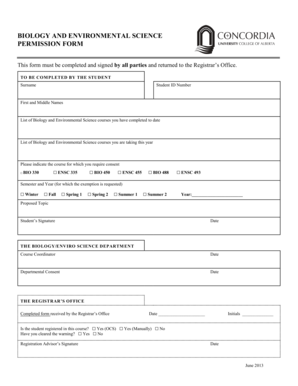

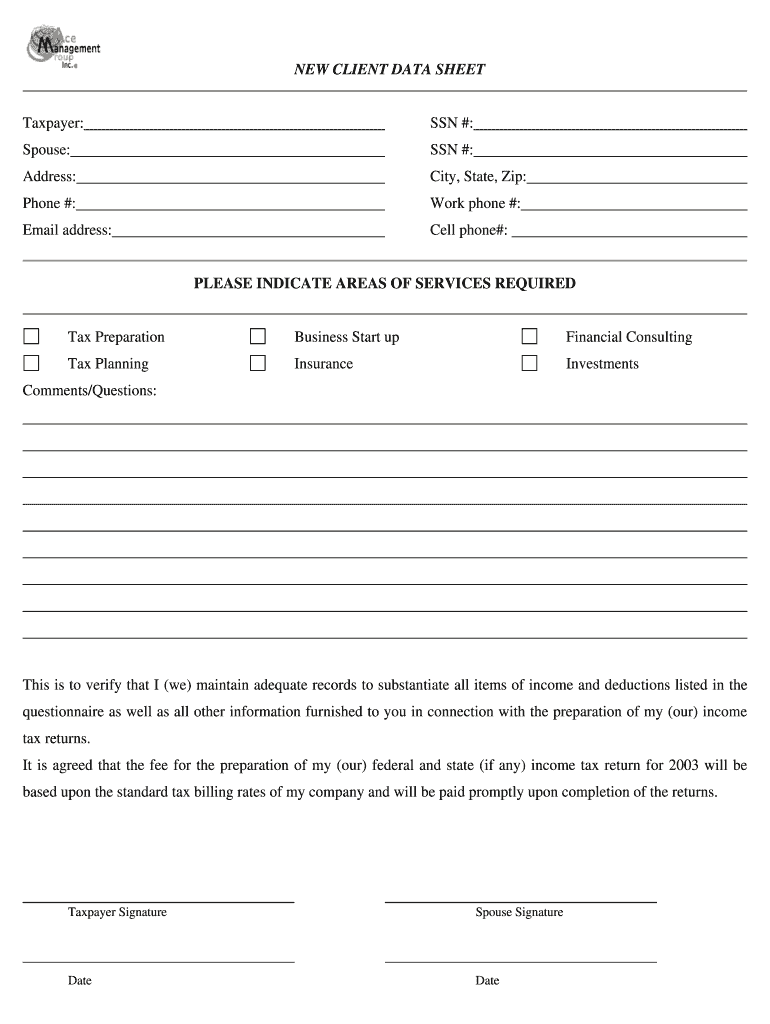

NEW CLIENT DATA SHEET Taxpayer: SSN #: Spouse: SSN #: Address: City, State, Zip: Phone #: Work phone #: Email address: Cell phone#: PLEASE INDICATE AREAS OF SERVICES REQUIRED Tax Preparation Business

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your printable online tax forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your printable online tax forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing printable online tax forms online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax federal form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out printable online tax forms

How to fill out tax service?

01

Gather all necessary documents, such as W-2 forms, 1099 forms, receipts, and records of income and expenses.

02

Calculate your income and expenses accurately to determine your taxable income.

03

Determine which tax forms you need to fill out based on your individual circumstances, such as Form 1040 for individuals or Form 1120 for businesses.

04

Carefully review the instructions provided with each tax form to understand the requirements and fill out the form correctly.

05

Fill out the tax form accurately, providing all required information, including your personal details, income sources, deductions, and credits.

06

Double-check all information entered on the tax form to ensure its accuracy and avoid any mistakes.

07

Sign the tax form where required, either physically or electronically, to certify the accuracy of the information provided.

08

Submit your completed tax form along with any required additional documents to the appropriate tax authority, such as the Internal Revenue Service (IRS) in the United States.

Who needs tax service?

01

Individuals who earn income from various sources, including employment, investments, or self-employment, may need tax services to ensure their tax forms are completed accurately and in compliance with tax laws.

02

Small business owners or self-employed individuals who need to file business tax returns, such as sole proprietors or freelancers, often rely on tax services to navigate the complexities of business taxation.

03

Individuals or businesses with complex financial situations, such as those dealing with multiple investments, rental properties, or international tax obligations, may require the expertise of tax professionals to handle their tax services effectively.

04

Taxpayers who are unsure about their eligibility for certain deductions or credits may seek tax services to optimize their tax savings while staying compliant with tax laws.

05

Individuals or businesses facing audits or other tax-related issues may benefit from tax services to ensure they have proper representation and guidance throughout the process.

Video instructions and help with filling out and completing printable online tax forms

Instructions and Help about records service form

Fill federal taxpayer form : Try Risk Free

People Also Ask about printable online tax forms

What is a w9 form used for?

Who is required to fill out a w9?

What is the difference between a 1099 and W-2?

What is a 1099 tax form?

What is a 1040 tax form?

What is a 1099 tax form used for?

Is a 1040 the same as a w2?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax service?

Tax service is a service that provides assistance and advice related to the filing of income taxes. Tax services can help individuals or businesses understand tax regulations, prepare tax returns, and minimize tax liability. Tax services may also provide additional services such as audit defense and tax debt resolution.

Who is required to file tax service?

Generally speaking, all individuals and entities who earned income during the tax year are required to file a tax return. This includes, but is not limited to, individuals, corporations, partnerships, estates, and trusts.

When is the deadline to file tax service in 2023?

The deadline to file taxes in 2023 is April 18, 2023.

What is the penalty for the late filing of tax service?

The penalty for late filing of tax returns is 5% of the unpaid taxes for each month that a return is late, up to a maximum of 25%. If you file your return more than 60 days late, the minimum penalty is the smaller of $135 or 100% of the unpaid tax.

How to fill out tax service?

To fill out a tax service, you can follow these steps:

1. Gather all necessary documents: Collect all relevant documents such as W-2 forms, 1099 forms, investment statements, and receipts for deductions.

2. Choose a tax preparation method: You can choose to manually fill out paper forms or use tax software or online platforms like TurboTax or H&R Block.

3. Provide personal information: Begin by providing your personal information, including your name, address, Social Security number, and any other required information.

4. Enter income details: Carefully enter the income details from your W-2 forms, 1099 forms, and any other income sources. Ensure accuracy and double-check all figures.

5. Claim deductions and credits: Fill out the sections related to deductions and credits you qualify for. This may include deductions for student loan interest, mortgage interest, medical expenses, or credits like the Child Tax Credit or Earned Income Tax Credit.

6. Calculate and report taxes owed or refund due: Determine your tax liability or refund using the information provided. Make sure to follow the instructions provided by the tax service or software accurately.

7. Review and double-check: Take the time to carefully review your completed tax return for any errors or omissions, ensuring everything is accurate.

8. Sign and submit: If using a paper form, sign and date the return before mailing it to the appropriate tax agency. If using tax software or an online platform, follow the instructions provided to electronically sign and submit your return.

9. Keep a copy: Make a copy of your filled-out tax service for your records. This can be useful for future reference or in case of any inquiries or audits.

Remember, tax laws and requirements may vary by country or region, so it's essential to consult relevant tax authorities or seek professional guidance if needed.

What is the purpose of tax service?

The purpose of a tax service is to assist individuals, businesses, and other entities in fulfilling their tax-related obligations and easing the process of tax compliance. Tax services may include preparing and filing tax returns, advising on tax planning strategies, and providing guidance on tax laws and regulations. They can help minimize tax liabilities, identify eligible deductions and credits, ensure accuracy and compliance with tax laws, and provide expert advice on complex tax matters. Overall, tax services aim to facilitate the timely and accurate calculation, reporting, and payment of taxes for their clients.

What information must be reported on tax service?

The information that must be reported on a tax service can vary depending on the jurisdiction and the type of tax being filed. However, some common information that may need to be reported includes:

1. Personal information: This includes the taxpayer’s full name, address, Social Security Number or Taxpayer Identification Number, and contact information.

2. Income details: All sources of income must be reported, including wages, salaries, self-employment income, interest, dividends, rental income, capital gains, and any other income earned during the tax year.

3. Deductions and credits: Taxpayers must report any eligible deductions and credits they are entitled to, such as mortgage interest, student loan interest, educational expenses, medical expenses, property taxes, business expenses, child tax credits, and child and dependent care expenses.

4. Tax withholdings: If the taxpayer is an employee, they need to report the amount of federal and state income tax withheld from their paychecks throughout the year. This information is typically provided on Form W-2.

5. Investment and financial accounts: Taxpayers may need to report information related to their investment accounts, such as gains or losses from sales or trades of stocks, bonds, or mutual funds. They may also need to report income earned from interest-bearing accounts, dividends, or other investment income.

6. Business information: If the taxpayer is a business owner or self-employed, they will need to report their business income and expenses, including sales revenue, cost of goods sold, rental expenses, advertising expenses, and any other business-related costs.

7. Health insurance: Taxpayers may be required to provide information about their health insurance coverage, including whether they had qualifying coverage throughout the tax year or if they qualify for an exemption.

It is important to note that this list is not exhaustive, and the specific information required for tax reporting can vary based on individual circumstances and local tax laws. It is always recommended to consult with a tax professional or refer to the official tax agency guidelines for accurate and up-to-date information.

Where do I find printable online tax forms?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific tax federal form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out tax federal return using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign federal return form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit tax records return on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as tax information sheet. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your printable online tax forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Federal Return is not the form you're looking for?Search for another form here.

Keywords relevant to tax client data sheet form

Related to tax client data sheet template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.